Tesla’s stock took a hit on Monday amidst a broader selloff triggered by President Trump’s imposition of new tariffs. The latest blow to the electric vehicle maker came as Wedbush analysts, headed by prominent Tesla supporter Dan Ives, significantly reduced their price target for the company’s stock.

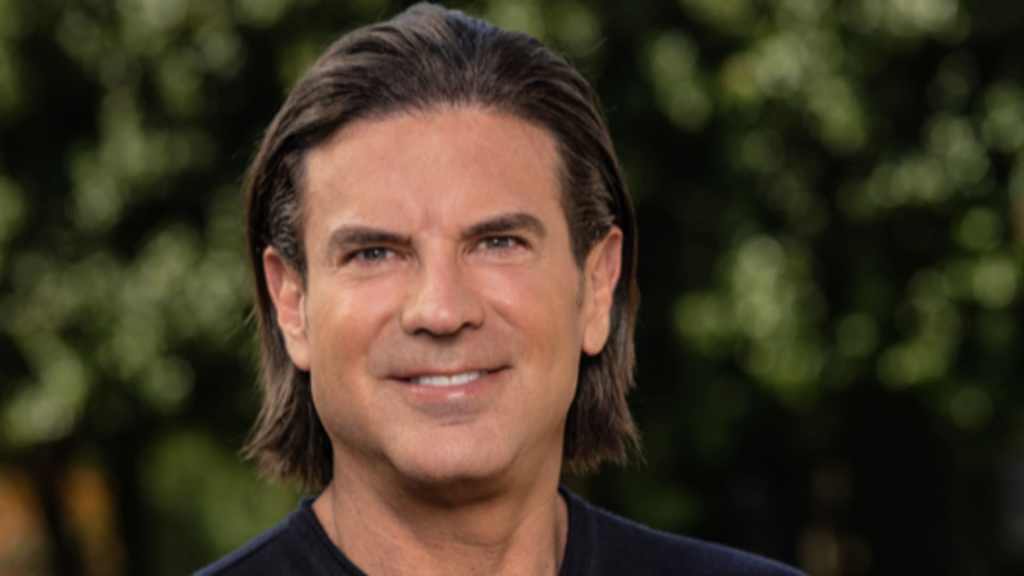

Ives and his team at Wedbush slashed Tesla’s price target by nearly half, reflecting a more cautious outlook on the company’s performance. The decision to downgrade the price target indicates a shift in sentiment from one of Tesla’s most ardent supporters.

The downward revision in the price target comes at a time of increased market volatility, driven by geopolitical tensions and trade uncertainties. The impact of President Trump’s tariffs on various sectors, including the automotive industry, has added to the already challenging environment for companies like Tesla.

Tesla’s stock has been particularly sensitive to external factors, with any negative news or developments in the market having a significant impact on its share price. The adjustment in Wedbush’s price target could further weigh on investor confidence in Tesla’s long-term prospects.

Despite the price target cut, some analysts believe that Tesla’s fundamentals remain strong and that the company has the potential to bounce back from the recent setbacks. The electric vehicle market is still seen as a growth opportunity, albeit with increasing competition and regulatory challenges.

Investors will be closely watching how Tesla navigates through the current market conditions and whether it can deliver on its production and delivery targets in the coming quarters. The company’s ability to innovate and stay ahead in the rapidly evolving electric vehicle landscape will be key to its future success.

As Tesla continues to face headwinds in the market, the decision by Wedbush to lower its price target underscores the uncertainty surrounding the company’s outlook. The coming weeks will be crucial for Tesla as it seeks to regain investor confidence and prove its resilience in the face of mounting challenges.