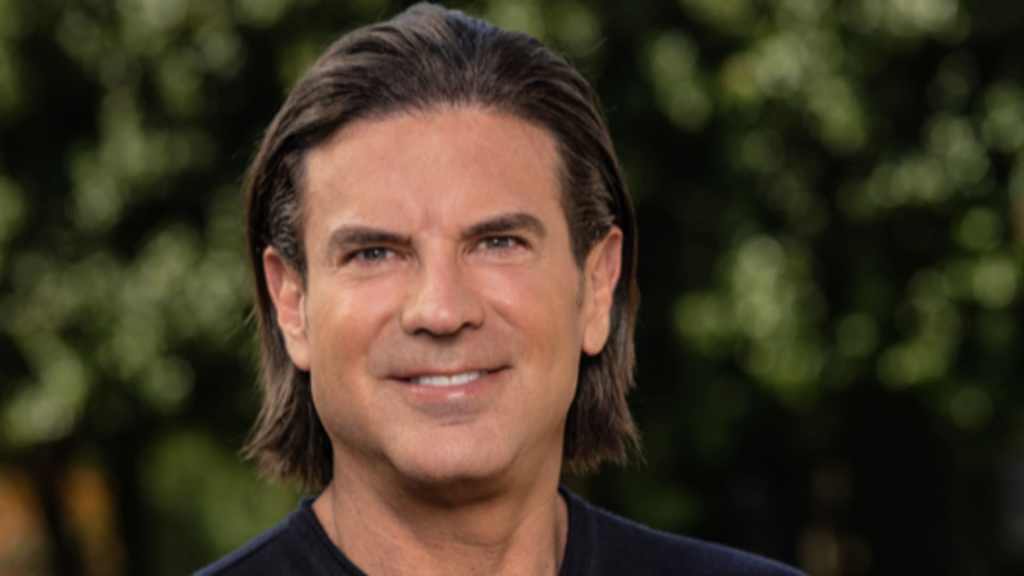

Entrepreneur David Adelman is at the forefront of a new wave of deal-seeking family offices, touting their ability to offer specialized expertise and patient capital beyond what traditional private equity or venture funds can provide. In a recent feature in CNBC’s Inside Wealth newsletter with Robert Frank, Adelman highlighted the unique advantages that family offices bring to the investment landscape.

Family offices, often representing wealthy individuals or families, have been increasingly active in seeking out investment opportunities, leveraging their deep industry knowledge and long-term investment horizon. Adelman emphasized that family offices are well-positioned to offer a level of expertise and commitment that surpasses what is typically found in conventional investment firms.

In contrast to private equity or venture capital funds, family offices are not bound by the same time constraints or pressure to deliver immediate returns. This flexibility allows them to take a more patient approach to investments, focusing on long-term value creation rather than short-term gains. Adelman underscored the importance of this extended investment horizon in driving sustainable growth and maximizing returns over time.

Moreover, family offices are often able to offer a more personalized and tailored approach to investment strategies, catering to the specific needs and objectives of their clients. This bespoke approach can lead to more strategic and impactful investment decisions, aligned closely with the goals and values of the families they represent.

Adelman’s insights shed light on the evolving landscape of wealth management and investment, where family offices are increasingly carving out a prominent role in driving innovation and growth. As more high-net-worth individuals and families turn to family offices for their investment needs, the traditional dynamics of the financial industry are undergoing a notable shift.

The rise of deal-hungry family offices, led by visionaries like David Adelman, signals a broader trend towards a more customized and long-term approach to investment management. By leveraging their expertise, patient capital, and personalized strategies, family offices are poised to shape the future of the investment landscape and offer unique opportunities for high-net-worth investors seeking differentiated and impactful investment solutions.

For more exclusive insights and updates on wealth management and investment trends, subscribe to CNBC’s Inside Wealth newsletter with Robert Frank to stay informed about the latest developments in the high-net-worth investor and consumer space.